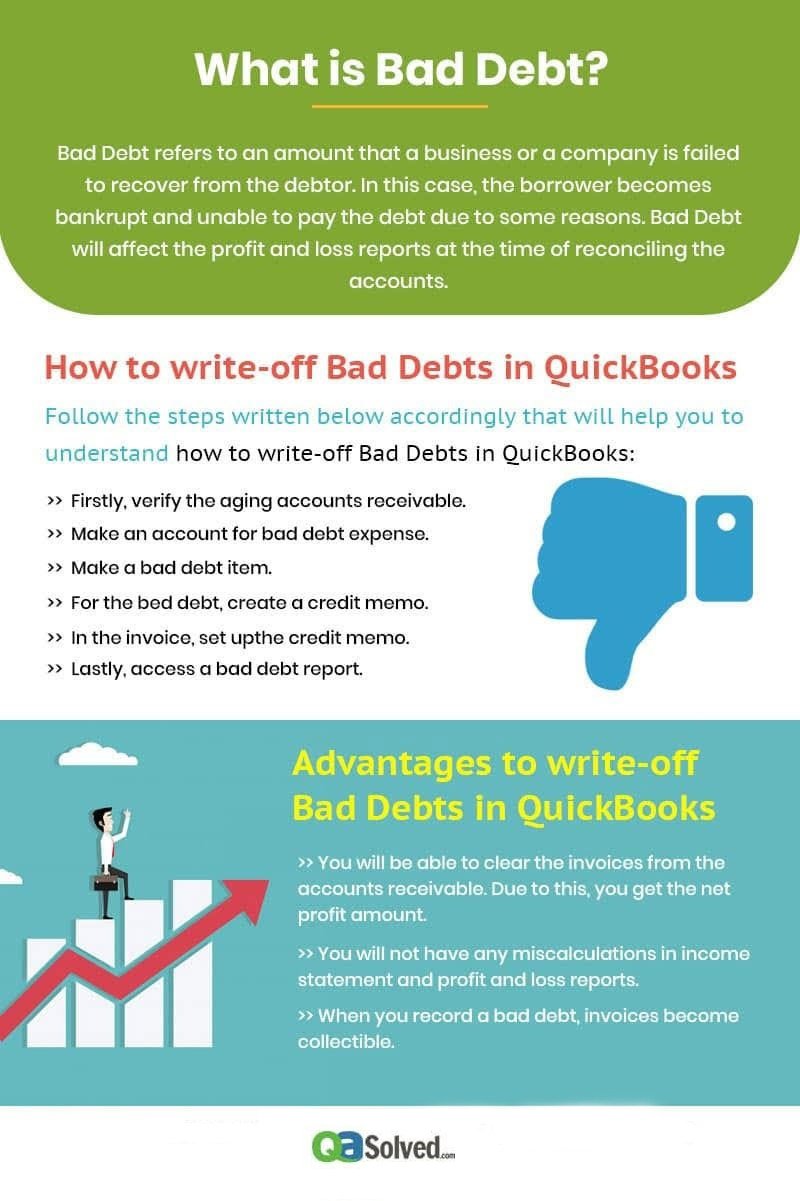

A bad debt is an amount that a business or a company is unable to recover from the debtor in case the borrower has gone bankrupt or is unable to pay the debt for some reasons. Debt issues can severely affect the profit and loss reports while reconciling the accounts in QuickBooks. Bad debt is generally related to account receivables and is also referred to as non-collectible account. The reason why having a bad debt account and writing off bad debts is essential is to avoid discrepancies in the income statement and profit and loss reports. That is why it is very important for businesses to write off bad debt in QuickBooks Online that often make sales on credits like finance companies require managing a separate bad debt account to write off the bad debts that can’t be collected. By writing off bad debts in QuickBooks, you can clear the invoices from the account receivables that help you get the correct net profit amount in QuickBooks. Now you might be wondering how to write off bad debt in QuickBooks?

Well, this blog will provide you with the required information and steps to help you write off bad debt in QuickBooks. However, before we go through the steps of writing off bad debt, we must first learn how to write down and record them.

Steps to Write Off Bad Debt in QuickBooks

The following are the steps that will clear your “how to write off bad debt in QuickBooks Online” queries:

Examine the A/R Aging Report

- First, you will need to click on the ‘Reports’ section from the left side panel in QuickBooks.

- Then, you will have to search for the Accounts Receivable Aging report from the search bar at the top.

- Now to view your outstanding receivable account, you must click on the Accounts Receivable Aging Detail report.

Also Read: Transferring Chart of Accounts to a New QuickBooks File

Create the Bad Debt Account in QuickBooks

- Firstly, click on the Gear icon from the Company section and choose the Chart of Accounts option.

- Now, you will need to select the option to create a new account.

- Next, you must click on the Expenses option from the Account Type drop-down list.

- Then, select all your Bad Debts from the Detail Type drop-down list and type in Bad Debt in the Name field.

- Finally, click on Save and Close to end this procedure.

Set up a Service / Product Bad Debt Item

- First, click on the Gear icon and select Product and Services from under the Lists section.

- Second, you must choose the option of Product and Services from under the List section.

- Then, click on the new product and then from the Product / Service Information section click on the Non-Inventory option.

- Next, you will have to type Bad Debt inside the Name text box.

- Now, select the Bad Debt expenditure that you have created in the Income Account section.

- After that, unmark the “Is Taxable” check-box.

- Finally, you will need to click on the Save and Close option.

Set up a Credit Memo for the Bad Debt

- For the first step, click on the plus icon at the top of your QuickBooks dashboard.

- Then, you will need to select the Credit Memo under the Customers section.

- Next, you will have to select the customer from the Customer drop-down list.

- After that, choose the item that you have created for the bad debt in the Product / Service field.

- Now, type in the amount of bad debt / unpaid invoices with positive values.

- Navigate to the memo text box and type in the amount of bad debt in there.

- Finally, click on the Save and Close option to end complete this step.

GET INSTANT RESOLUTION

Get our expert Quickbooks ProAdvisor on call to resolve your query in no-time.

Implement the Credit Memo to Apply for Credits

- Start this process off by clicking on the plus icon located at the top of the screen and then navigate to the “Receive Payment from the Customers” section.

- Next, you will need to select the customer from the Customer drop-down list.

- Then, select the invoice that you want to write off from the Outstanding Transactions menu.

- After that, you will have to select the credit memo that you have created from under the Credits section.

- Run a check and affirm that the amount reflecting in that section is $0.00.

- Finally, you must click on the Save and Close option to end this procedure.

Once you are done with setting up bad debt account in QuickBooks, you can efficiently run reports and view all the bad debts and unpaid invoices. To run the bad debt report, click the Gear icon and from under the Your Company section select Chart of Accounts, search for Bad Debt and from the Action drop-down click on Run Report.

In Conclusion

The reason why it’s so important to remove and write off bad debts is to avoid any sort of fiscal disparities. Following the aforementioned steps will help you in writing off bad debts in your QuickBooks software. These steps will guide you in examining, creating, setting up and implementing your debt-related data.

We hope that this blog taught you how to write off bad debt in QuickBooks. In case you are still facing issues with writing off bad debts in QuickBooks or simply are seeking the aid of an expert technician to resolve any QuickBooks related issue that you might be experiencing, feel free to contact the toll-free QuickBooks Support Number.

FAQs

A: Follow up on the underneath steps to write off a bad debt invoice in QuickBooks.

1. To track the bad debt, you need to add an Expense account. For this, select the Lists Menu and choose the Chart of Accounts option. Now, choose the Account menu and click the New option.

2. Secondly, exclude the unpaid invoices. For this, choose the Customers Menu and click on Receive Payments.

A: Underneath are the steps to write off a bill in QuickBooks.

1. Initially, launch the invoice that you need to write off.

2. Now, create a new credit memo and enter the identifying information for it.

3. After that, generate the bad debt expense.

4. Next, enter all the required details in the credit memo.

5. Finally, put in the credit memo to the invoice.

A: You can apply the following steps to write off customer balance in QuickBooks.

1. First of all, choose Pay Bills from the Vendors menu.

2. After that, click on the bill that needs to be written off.

3. Now, choose Set Discount.

4. And the, select the Discount tab and type the amount of the discount filed.

5. Next, click on the Pay Selected Bills option.

6. Finally, choose Done in the Payment Summary Window.

A: You can write off a bad debt expense under the direct write-off method by following the underneath steps.

1. Debit Bad Debts Expense

2. Credit Accounts Receivable

A: Bad debt shows the amount of money that a customer owes but you are failed to collect it. You need to record uncollectible invoices as a bad debt in QuickBooks. It ensures that the net income and accounts receivable stay up to date.

A: The best method to see the debt has been written off is to verify the credit report. However, the company you be in debt has written off the debts and your account may be shown to a collection agency for recovery.

A: Check out the following steps to write off bad debt in the QuickBooks Desktop.

1. The first step is to choose the Lists Menu and then click on Chart of Accounts.

2. After that, go to the Accounts menu and choose New.

3. Next, choose the Expense option and then select New.

4. Now, write down the Account name.

5. Finally, choose Save and Close.

A: The sales and general administrative expenses are considered as bad debt expenses. Bad debts are responsible for the reduction to accounts receivable on the balance sheet. Your accounts receivable and net income stays the latest after writing off bad debt.

A: Below-mentioned are the journal entries to record when a specific customer’s account is identified as uncollectible.

1. A debit to Allowance for Doubtful Accounts

2. A credit to Accounts Receivable

A: There are two methods to estimate bad debt expense’ written as follows.

1. The percentage sales

2. Account receivable aging